海外に引っ越すとき、いつなら住民税がかからなくなるか

海外に引っ越すのですが、住民税はどうなるでしょう?

海外に転勤になる、あるいは海外の自宅に引っ越して戻ってしまうときに、日本の住民税の支払いはどうなるでしょうか。

脱税はダメですが、住民税の基本も理解した上で引っ越し時期を決めるのは節税の一種となるでしょう。住民税の基本的な課税と節税を学びましょう。

住民税の基本知識

住民税は、1月1日現在でその市町村に住所がある方について課税がされます。

1月1日に住所があるから課税されるのですが、裏返せば、なければ課税がされないことになります。1月1日時点の住所の市町村から5月末くらいに納付書が届き、6月から1年間分の住民税として、翌年の5月まで支払いが続きます。

もし、あなたが会社に勤めていれば、住所の確認は会社と行う形(特別徴収)でしょう。そして、自分で直接市町村に払っている場合(普通徴収)は、直接納付書が届きます。これが5月くらいです。

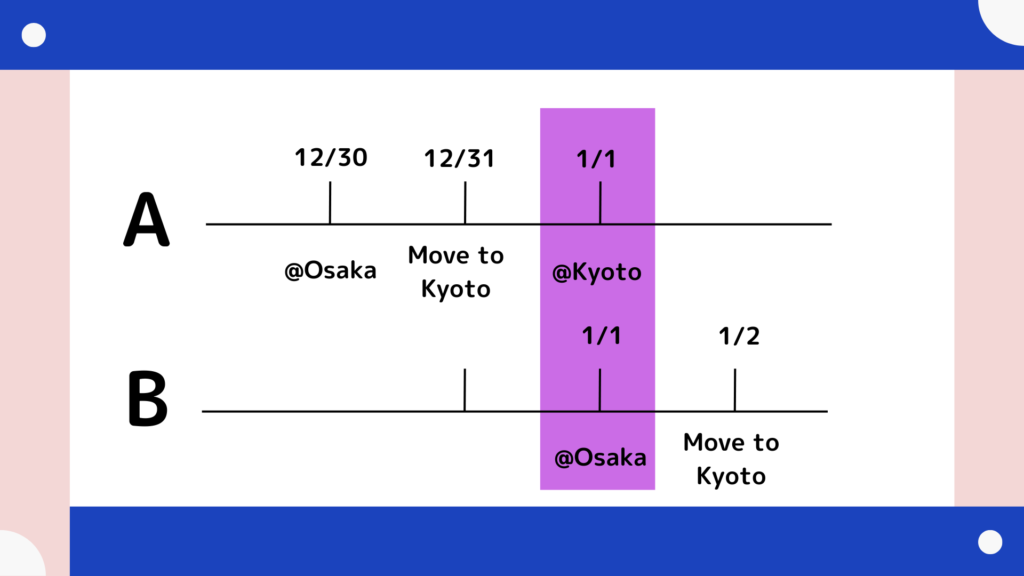

例えば、12月30日まで大阪市に住んでいて、12月31日に京都市に引っ越すとします。この場合は、1月1日現在の住所は京都市にありますので、京都市から住民税の納付書が届くことになります。

少し微妙ですが、これが、1月1日まで大阪市に住んでいて、1月2日に京都市に引っ越した場合に、住民税の課税は、大阪市から来ることになります。

図にまとめると、このようになります。1月1日時点で住所がどこにあるかがポイントです。

しかし、この時点だけで6月以降の1年間の住民税の支払い場所が変わるのは、一般の方には分かりづらいかもしれません。

海外に移住した場合の住民税

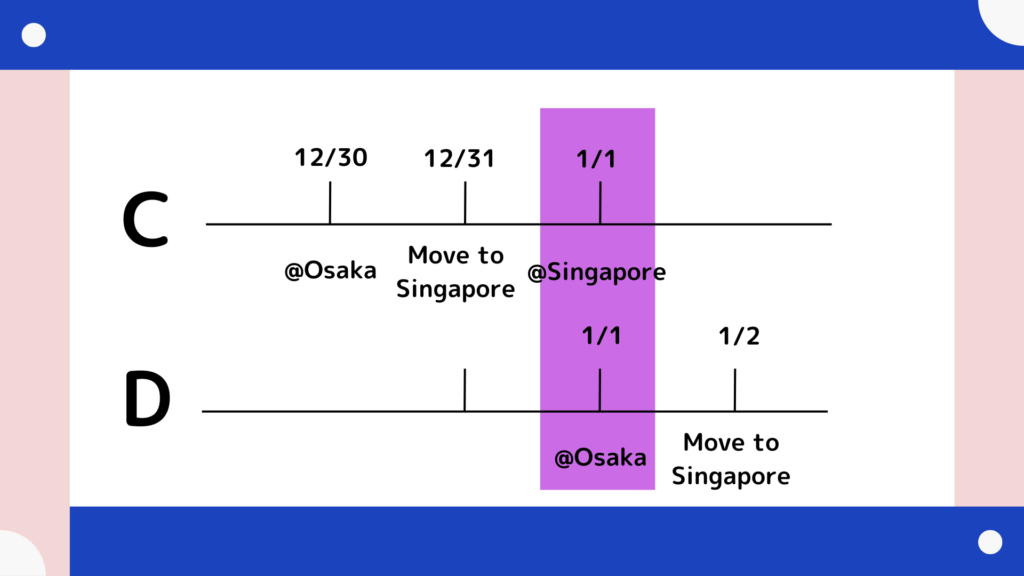

上記の内容が海外になると、課税されるかどうかが変わります。先程のAとBは両方ともに国内の話でした。今度は海外に行きましょう。

Cの場合には、1月1日に日本に住所がないことになります。結果として、Cの場合は日本で住民税がかかりません。

一方、Dの場合は、1月1日に日本に住所があることになります。この場合は、日本の住民税を支払う義務があります。日本にいないじゃないか?という話があるかもしれませんが、原則的にこうなるのです。

納税管理人

上記Dの場合には、出国時に納税管理人(Tax Agent)を設定する必要があります。

また、納税が漏れる可能性も気をつけましょう。よくあるのは、納税漏れです。2023年1月2日にシンガポールに引っ越した場合に、2023年6月から2024年5月分の住民税を一括納付したとします。これはもちろん大丈夫です。

しかし、2023年1月1日時点で大阪市に住所があるということは、2024年6月から2025年5月までの住民税の納税義務が生じます。そして、この新たな税額について納税通知書を受けていないはずです。この部分の納付漏れが発生しやすいです。

納税管理人の設定のが必要かきちんと確認しておきましょう。

住民基本台帳への登録を見ている

住所のあるなしは、どこで判断するのでしょうか?それは、住民基本台帳(Basic Resident Registration System)に載っているかどうかです。

手続きが漏れていたり、実際の引越し日が12月31日でも、届け出で引っ越し日付を1月2日などと記載してしまうと、住民基本台帳の登録として、1月1日に住所がその市町村にあることになります。

この場合、課税がされます。

実態も見ている

では、引っ越しは1月2日なのだけれども、住民基本台帳の届け出として12月31日の引っ越しと届け出ればいいのではないか?という考えがでるかもしれません。この場合は、逆に課税される可能性があります。

基本は住民基本台帳に載っているかということを見るのですが、現状を見て引っ越していない状態だと分かった場合、実態に対して課税することになります。

税金関連での虚偽申告は問題になりますので、気をつけておきましょう。