インボイス制度への反対の話をちょくちょく報道で耳にします。

「インボイス」は消費税の控除や還付を受けるために必要な請求書やレシートのことで、来年10月の制度導入後、事業者は取引先からインボイスの発行を求められるケースが想定されます。

一方、現在、消費税が免税されている小規模事業者は、インボイスを発行するために必要な登録を行うと、新たに消費税の納税義務が生じるため、市民グループは、小規模事業者にとっては実質的な増税に当たるとして制度の中止や導入延期を訴えました。

NHK「インボイス制度」反対する市民グループが都内で大規模集会 2022年10月27日 4時57分

インボイス制度の番号登録は強制ではないです。

インボイス制度のために、わざわざ納税義務者になる必要はないでしょう。

インボイス制度に反対という報道がされます。

報道機関は、あまり主張を挟まないのか、事実だけを述べるような口調が多めです。

直接語られにくいですが、本当の論点は小規模事業者が今まで受けていた益税部分の利益を受けられなくなることです。

受けていた益税を得られなくなることを「実質的な増税」と呼ぶのは、プロパガンダな印象を受けます。

国税庁側でも段階的な控除の適用をさせるようにしていますし、むげにしているわけでもないですが。

また、真に心配するのは、大企業と小規模事業者の取引ではなく、消費税の納税義務がある小規模事業者と消費税の納税義務がない小規模事業者の取引がちゃんと続くかでしょう。

益税問題

1989年(平成元年)に導入がされた消費税。

益税というのは常に問題でした。

消費税の納税義務があるAさんと、消費税の納税義務がないBさんでは、同じ取引でも利益が異なっています。

消費税として預かったように見えて結局Bさんの懐に入っている部分を益税といいます。

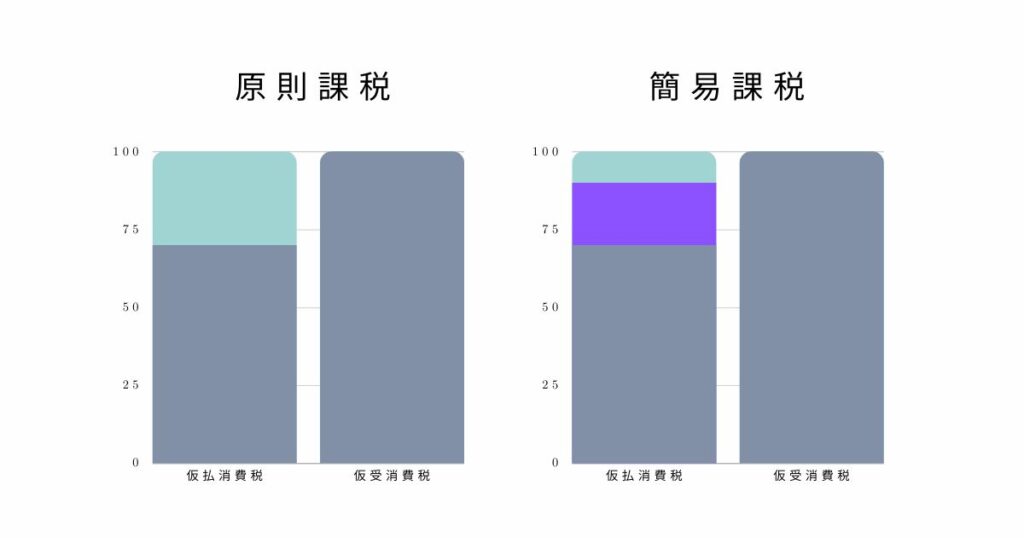

益税が発生するのは簡易課税の場合と免税事業者の場合です。

例えば、1000万円の売上があって、仮受消費税が100万円。

700万円の仕入れがあって、仮払消費税が70万円とします。

この差額、30万円を国等に納付するのが原則課税。

簡易課税で、みなし仕入率が90%とすると、1000万円の90%について10%の仮払消費税がかかるとして90万円。

差額として国等に納付する消費税額等が10万円となります。

よって、紫の20万円が益税です。

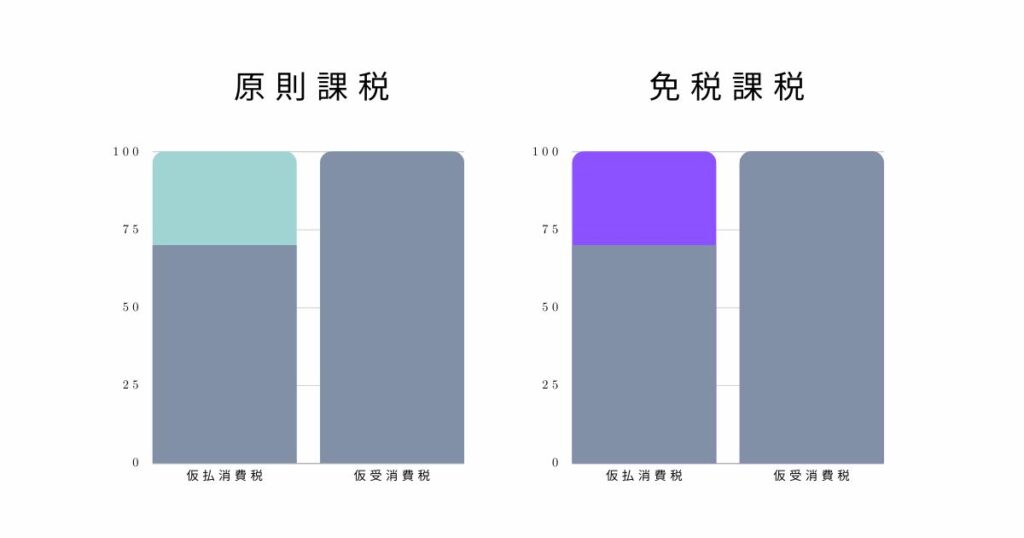

免税事業者でも益税が発生します。

納税義務が当期あるとして、原則課税であれば、緑部分は納付します。

それが免税事業者であれば、消費税分を徴収していても国等に納付しなくていいです。

同じ取引をしているのにAさんとBさんは不公平ですね。

課税の公平性から、こういった益税は問題視されていました。

ただ、1989年当時から消費税の導入における事務負担が小規模事業者にあることから、一定の方に対して消費税が免除されてきました。

そのため益税が発生しています。

免除対象が縮小されつつも、益税がなくなることはありません。

事務の手間はそこまで?

では、事務の手間は大変だったのでしょうか。

1989年の導入に対して考えるのが、マイクロソフトオフィスの導入時期です。

1993年6月25日*1となっていますね。

1989年当時に消費税を計算するにあたっては、ほとんどExcelなどは使えなかったでしょうし、専用の会計ソフトを導入する必要があったでしょう。

例えばクラウド会計の一例でfreeeさんは、2012年の設立です。

他の会社もありますが、会計ソフトの進歩はめざましく、銀行の動きと連動して当たり前、売上台帳とも連動して当たり前の時代になっていますね。

今後peppolが導入され、世界標準規格で請求書のやりとりがスムーズになる動きもあります。

手間ということでの免税の理由は減りつつあります。

経過措置はある

といっても、免税事業者からの消費税額等の請求すべてが急に控除できなくなるわけではありません。

以下のような経過措置がございます。

令和5年10月1日から令和8年9月30日まで 仕入税額相当額の 80%

令和8年10月1日から令和11年9月30日まで 仕入税額相当額の 50%

益税は預り金か?預り金的性格か?

とある政党が国会で財務省に対して、消費税が預り金かどうかを質問して消費税の論理性を切り崩そうとしています。しかし、主要な論点は、預り金の定義ではなくどういう税体系になっているかです。本ブログでの議論を見ていただくと、これまで益税として得をしている事実があり、その点に対して対処しようとしてることは理解できるでしょう。

「預り金」かどうかにこだわって質疑をして消費税の論理性を崩そうとしている例をみてみましょう。

【政党側】(1990年東京地裁判決では)「益税、預り税ではない」と言っています。また、「消費税は売上金の一部であり、預かり金ではない」となります。そこで政務官にお伺いします。消費税はこの旧大蔵省が主張したとおり、「預かり税じゃない」ということで、よろしいですか?

集英社オンライン「インボイス導入根拠がついに論理破綻! 「消費税は預かり金ではない」と政府が国会で認めた決定的答弁の詳細」(2023年2月28日[2023年4月5日最終確認])。 政党名等は筆者が修正して引用。

【財務大臣政務官】多くの皆様方に誤解を与える答弁を過去ずっとさせて頂いているのかもしれませんが、「預かり金的な性格でありまして預かり税ではありません」という答弁を過去ずっと財務省はさせて頂いております。

上記の前提の確認はいいのですが、次で論理飛躍があります。

【政党側】「預り税ではない」ということで私の認識と一致しております。要するに、「益税は無い」ということですね。そういうことですね。益税には当たらないと。

集英社オンライン「インボイス導入根拠がついに論理破綻! 「消費税は預かり金ではない」と政府が国会で認めた決定的答弁の詳細」(2023年2月28日[2023年4月5日最終確認])。 下線部筆者。

ここでの前提は「預り金=益税」だから、預り金でないなら益税ではないという言い方です。ここで論理が飛躍してしまいます。「預り金=益税」という単純化はできません。

小規模ではなく、売上高が5億円超の大企業を考えてみましょう。消費税の設計上実は消費税を払っていない部分についても支払ったとできる場合があります。100億円を売っていて10億円の消費税を受け取っている、70億円の仕入れをしていて7億円の消費税を払っているとすると、納税するのは、10億円―7億円で3億円となります。しかし、消費税を払っていないのに控除できてしまう仕組みが存在します。実際に6億5,000万円の消費税しか払っていないかもしれません。この場合の納税額は3.5億円のはず。しかし、実際は3億円で、5,000万円の得をしています。この5,000万円も益税と呼びます。

この5,000万円は明らかに預り金ではありません。しかし、益税です。消費税の理論上、税の累積を避けるための仕組みのひずみです。税は政治に大変影響を受けるのですが、税法自体は、多くの人からのツッコミを受けるもので、かなり厳密にできています。

なお、他にも益税として出てくる論点がございます。

益税問題を解決するのは不公平か?

今まで益税を受けていた方にとって、消費税分が受けられないことは大きな痛手でしょう。

受けていない方にとっては関係がないです。

どちらの立場に立つべきでしょうか。

最近起業した方もいらっしゃるでしょうが、消費税の益税を受けられる状態で30年以上放置をしていた状態でした。

課税の不公平さもありますが、小規模事業者の事務負担に対して衡量して今までは益税を放置していたのですね。

ギリギリ小規模事業者になった方から見れば、どうしてAさんは益税を受けられるのに、私は消費税を払わないといけないんだと考えるはずです。

小規模の事業者の税負担のバランスをとっていくことは経済活性化の観点から必要でしょう。

ただ、課税の公平性という観点からは、不公平の解消という方が合っていそうです。

報道のように、今まで受けていた利益部分がなくなることを増税というのは、いささか以上に誤解を生む表現と感じます。

*1 Microsoft Office. (2022, November 3). In Wikipedia. https://ja.wikipedia.org/wiki/Microsoft_Office

*2 freee. (2022, October 23). In Wikipedia. https://ja.wikipedia.org/wiki/Freee