デジタルインボイスの動きが少しずつあります。

Peppol(ペポル)と呼ばれる仕組みです。これが先に導入になっていれば、電子帳簿保存法の対応が楽だった気がします。逆に、電子帳簿保存法であれだけゴタゴタしているので、ちゃんと定着しない可能性があります。

「Peppol」という言葉は、デジタルインボイスを扱う企業にとっては非常に重要な存在です。Peppolは、電子的に発行されたインボイスを効率的に交換することを可能にする、グローバルな電子ビジネススタンダードです。この記事では、Peppolが日本のデジタルインボイシステムにどのような影響を与えるかを解説し、Peppolの利点や導入方法についても触れてみます。デジタル時代にふさわしい効率的なインボイス管理方法を模索している方は必読の内容です。

使えば便利になるので、ハイエンドの方は使うでしょう。また、こういったものを使わない方と、仕事のやり方で差がでそうです。

- デジタルインボイスとはなんですか?

- デジタルインボイスのメリットとはなんですか?

- Peppolとはなんですか?

- Peppol規格とは?

- Peppolを活用する利点とは?

- デジタル庁のJP PINTとは?

- Peppolを利用する企業とは?

- Peppolアクセスポイントとは?

- Peppol BIS Standard Invoice JP PINT Version 1.0とは?

- Peppolの普及に向けた取り組みとは?

- Peppolでやり取りできる文書の種類は?

- デジタルインボイスとPeppolとの関係は?

- Peppolの基本的な仕組み

- EIPAとはなんですか?

- データ上の利点:OCRの能力限界値を加味しなくていい

- EDIとどう違うか?

- サービス業者が狙う波及オプションとして

- Peppol認定アクセスポイント事業者 2022年10月19日現在

- Peppolのサービス業者

- 過去の例から、本腰入れないと定着が難しい

デジタルインボイスとはなんですか?

従来、企業間で請求書を送受信する場合、紙の請求書を郵送したり、FAXで送信することが一般的でした。しかし、デジタルインボイスを導入することにより、業務の効率化や環境負荷の軽減が期待できます。

デジタルインボイスは、標準化され構造化された電子請求書のことです。

必要な情報が構造的に発行者から受領者へやりとりできます。

売り手を例に、具体的な内容を確認してみましょう。

売り手のデジタルインボイスの内容例

- 販売者の電子アドレス (ibt-034)、必須

- 販売者識別子 (ibt-029) を使用する場合、識別スキーム識別子は、ISO/IEC 6523 保守機関によって発行されたリストのエントリから選択する

- 販売者の商号 (ibt-028)

- セラーの国コード (ibt-040)

- 販売者の税務登録 ID (ibt-031)

- 売り手の税登録の税制(VAT や GST など)

- 販売者の正式な登録名 (ibt-027)

- 販売者の法的登録識別子 (ibt-030) を使用する場合、識別スキームの識別子は、ISO/IEC 6523 保守機関によって発行されたリストのエントリから選択する必要があります

- 販売者の連絡先 (ibg-06)

デジタルインボイスの導入には、業務フローの見直しやシステム導入が必要ですが、導入することで、紙の請求書やFAXによるやり取りの手間やミスを減らすことができ、業務のスピードアップにつながります。また、導入に伴い、環境負荷も低減でき、CSR(企業の社会的責任)への取り組みとしても注目されています。

こういった情報をデータで直接やり取りできれば、請求書のフォームなどが異なっていても困りません。ただし、デジタルインボイスを導入する場合には、専用のシステムやツールが必要であるため、コストや手間がかかる場合もあります。また、デジタルインボイスを導入する場合には、法的に認められた手続きが必要であることにも注意が必要です。

デジタルインボイスのメリットとはなんですか?

デジタルインボイスを使うことで得られるメリットは以下の通りです。

デジタルインボイスのメリット

- 紙のコスト削減:紙の請求書を使用する場合にかかる印刷や郵送にコストを、デジタルインボイスを使用することで削減することができる

- 環境保護:デジタルインボイスを使用して紙の使用量を削減し、環境にやさしいビジネスを行える

- タイムリーな支払い:デジタルインボイスは、紙の請求書よりも早く、正確に送信することができ、支払いの遅れを避ける

- 請求書の追跡が容易:デジタルインボイスを使用することで、請求書の履歴を簡単に追跡でき、請求書が支払われたかどうかを迅速に確認できる

- 間違いをへらす:デジタルインボイスを使用することで、請求書の誤処理を軽減できる。手動でデータを入力する必要がなく、自動的に請求書が生成されるため、誤った数字や情報を入力する可能性が低くなる

- 保存容量の節約:デジタルインボイスを使用することで、紙の請求書を保存する必要がなく、保存容量を節約できるす。

これらのメリットから、デジタルインボイスは、ビジネスにとって非常に有益であると言えます。

Peppolとはなんですか?

Peppol(Pan-European Public Procurement Online)は、欧州の公共部門による電子調達システムです。このシステムは、欧州連合内の公共部門の調達業務において、電子的な調達手続きを実現するために設計されました。Peppolは、標準化されたデータ交換フォーマットと通信プロトコルを使用して、異なる国の業者との調達プロセスを効率化することができます。

Peppolネットワークには、公共部門の調達機関、業者、請求書サービスプロバイダーなどが参加しています。Peppolネットワーク上では、調達機関は電子的に入札依頼や入札提出のやり取りを行い、業者は電子的に入札提出や請求書の送信を行うことができます。請求書サービスプロバイダーは、業者がPeppolネットワークを介して請求書を送信できるように支援するサービスを提供しています。

Peppolの最大の利点は、異なる国の企業間での取引において、データ交換の効率を高めることができる点にあります。Peppolネットワーク上で、共通のフォーマットとプロトコルを使用することで、業者は異なる国の調達機関と電子的に取引を行うことができ、手続きの簡素化と時間とコストの削減が可能となります。また、Peppolネットワークは、セキュリティやプライバシーの保護などの観点からも高いレベルの信頼性を確保しています。

Peppol規格とは?

Peppol規格は、請求書や受発注書などの電子文書をやり取りするためのグローバルな標準仕様であり、Open Peppolが管理しています。デジタルインボイス推進協議会が、Peppolを日本国内の標準仕様に採用し、JP PINTを策定しました。この規格の導入により、企業間の取引がスムーズになり、業務の効率化が図られることが期待されています。また、Peppolの採用により、世界中どこでも電子文書のやり取りが可能になり、グローバルなビジネスに対応できます。

Peppolを活用する利点とは?

Peppolを活用する利点は、電子インボイスの管理が容易になることです。Peppolの利用により、送信される文書には整合性チェックが行われます。そして、受信したインボイスのデータについては、仕入税額控除の要件などにも適合性を確認することができます。また、Peppolに対応したシステム規格を導入すれば、取り込みだけでなく、システム処理やデータ活用まで高い効率で行うことができます。Peppolの普及が進むことで、取引先が幅広く利用できる低コストな電子インボイス環境が整備され、企業活動の効率化やコスト削減に寄与することが期待されます。

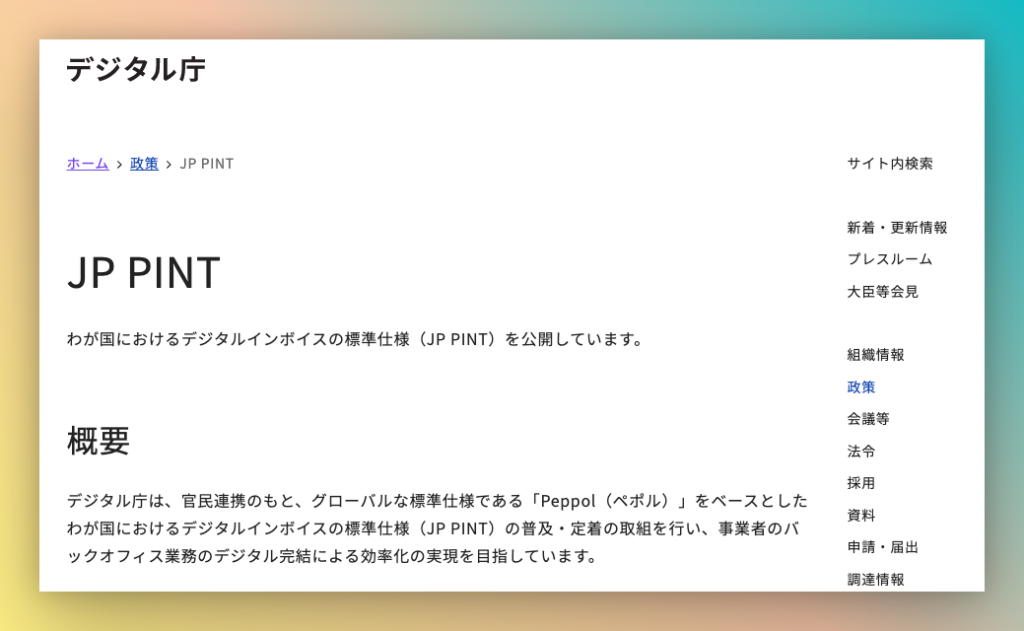

デジタル庁のJP PINTとは?

デジタル庁は、日本国内のデジタルインボイスの標準仕様として「JP PINT」を策定しています。この規格は売り手と買い手の間でやり取りされるデジタルインボイスの標準仕様であり、グローバルな標準規格であるPeppolに準じた仕様になっています。Peppolに準拠することで国際的な取引において問題なく電子請求書をやり取りすることができます。また、JP PINTの普及に向けデジタル庁とともにアクセスポイントプロバイダー事業者の認定も進められています。企業側にとっても取引のスピードアップやコスト削減につながるため積極的に利用拡大が進んでいます。

Peppolを利用する企業とは?

Peppolを活用するメリットや普及への取り組みが進む中、Peppolを利用する企業はどのようなものでしょうか。Peppolを利用する企業とは、主に国内外の大手企業や中小企業、自治体、そしてBtoB取引をしている事業者などが挙げられます。特に、海外との取引が多い企業や、複数の部署や拠点での取引がある企業にとっては、Peppolを利用することで効率的な取引が可能になるため、積極的に導入を進めています。また、Peppolアクセスポイントを提供する企業もあり、Peppolを利用する企業にも利用しやすい環境が整備されているといえます。

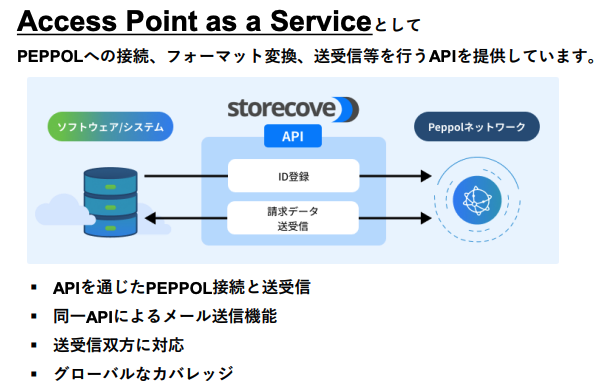

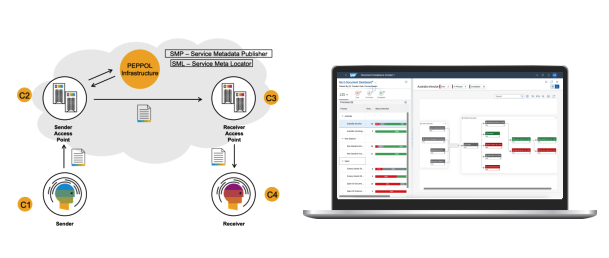

Peppolアクセスポイントとは?

Peppolネットワーク内で電子データの送受信を行うために必要な中継点がPeppolアクセスポイントです。ただし、このアクセスポイントに接続するには、Peppolを活用している事業者であることが必要であり、Peppol認定事業者によって提供されるサービスを利用する必要があります。Peppolにおけるデジタルインボイスの送信において、売り手のアクセスポイント(C2)と買い手のアクセスポイント(C3)が必要となり、それぞれがPeppolネットワークに接続してやり取りすることが可能です。Peppolアクセスポイントは日本においても普及が進んでおり、デジタル庁によって主導されています。Peppolアクセスポイントを利用することで、Peppolネットワークに接続することが可能となり、デジタルインボイスの送受信がスムーズに行えます。

Peppol BIS Standard Invoice JP PINT Version 1.0とは?

Peppol BIS Standard Invoice JP PINT Version 1.0とは、日本におけるデジタルインボイスの国内標準仕様の最新版である。この仕様書は、Peppol International (PINT)モデルに対応したものであり、請求書をデジタル化して送受信するための共通基盤を提供する。Peppol BIS Standard Invoice JP PINT Version 1.0の採用によって、企業間の請求書のやり取りが簡単かつ効率的に行えるようになる。また、デジタル化によってヒューマンエラーの発生リスクを低減できるため、業務効率化やコスト削減にもつながると期待されている。Peppol BIS Standard Invoice JP PINT Version 1.0は、2022年に予定されているデジタルインボイス制度の導入に向けて、デジタル庁によって正式公表されている。

Peppolの普及に向けた取り組みとは?

Peppolを活用したデジタルインボイスの普及に向け、デジタル庁を中心に官民連携による取り組みが進んでいます。現在は日本の電子インボイスの標準仕様であるJP PINTの策定が進められ、2022年秋にはPeppol対応サービスが提供可能となる予定です。また、Peppolアクセスポイントの認定を受け、国内での普及にも取り組んでいます。デジタルインボイスの普及により、請求業務のペーパーレス化だけでなく、自動化やバックオフィス業務の効率化、正確な処理の実現が期待されています。さらに、Peppolでやり取りできる文書の種類も多く、取り組みはますます進展しています。

Peppolでやり取りできる文書の種類は?

Peppolでは電子文書の種類は電子インボイスに限定されることはありません。製品の認定証や仕様書など、様々な種類の文書をオンラインネットワーク上でやりとりすることが可能です。しかも、これらの文書には電子署名を施して授受することができます。Peppolは公的調達やビジネス間の取引を容易にするための国際標準規格であり、ビジネスプロセスの効率化を実現することができます。企業、政府機関、各種組織がPeppolを活用することで、業務プロセスの効率向上や費用削減、環境負荷軽減といった効果が期待できます。Peppolの普及に向けた取り組みも進んでおり、ますます多くの企業がPeppolを利用することが予想されます。

デジタルインボイスとPeppolとの関係は?

デジタルインボイスは、請求書を電子的に送信する方法を指します。一方、Peppolは、欧州の公共部門における電子的な調達システムであり、異なる国の業者との調達プロセスを効率化するために設計された標準化されたデータ交換フォーマットと通信プロトコルを使用しています。

Peppolは、デジタルインボイスの受け渡しにも使用されます。Peppolネットワークを介して、公共部門の調達機関と業者は、電子的に入札依頼や入札提出のやり取り、請求書の送信を行うことができます。Peppolネットワークは、異なる国の業者との調達プロセスを簡素化し、データ交換の効率を高めることができます。

したがって、Peppolは、デジタルインボイスの受け渡しに関する標準を策定し、業者が請求書を電子的に送信できるようにすることで、ビジネスプロセスの効率化を促進しています。Peppolの導入により、異なる国の企業間での取引における請求書の受け渡しプロセスがスムーズになり、時間とコストの削減が可能となります。

Peppolの基本的な仕組み

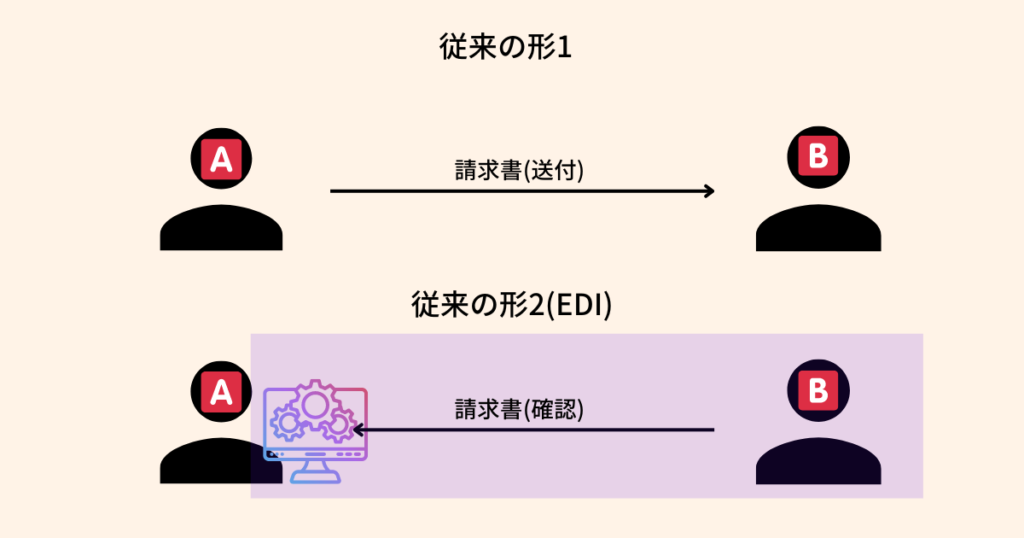

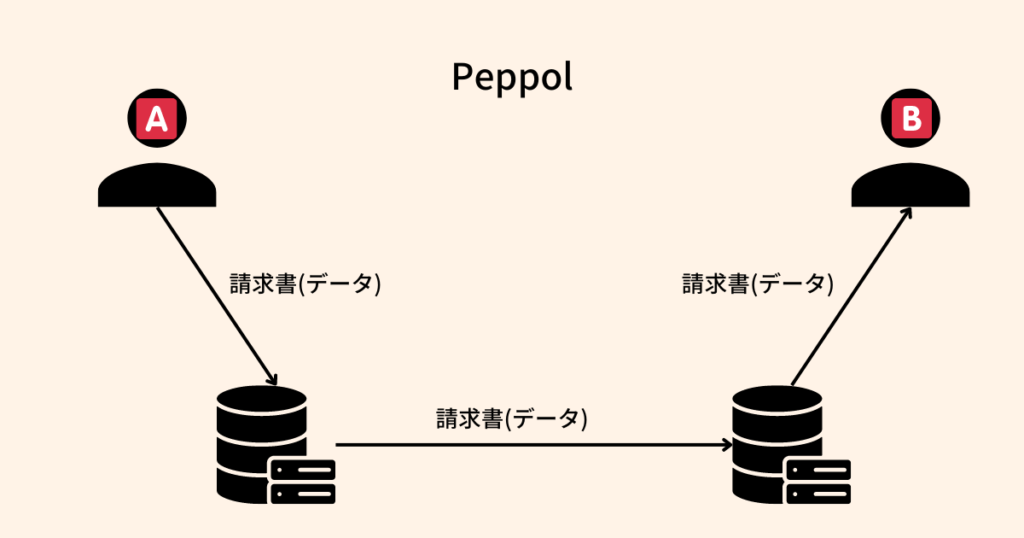

今までの請求書の送付はこういった形です。

- AからBへ現物やデータで送付をする

- AのシステムにBが入っていき、売買関係のデータを取得する

Peppolになると、アクセスポイント業者のサーバーを通じてAからBへ請求書データが送れるようなります。

あまり変わらないような気がするかもしれません。

でも、大きな違いは、請求書の記載事項に意味のある内容をもたせられること。

例えば、10,000円と書いてあったときに、それが単価なのか全体の支払金額なのか、判断が必要でした。

10,000円という金額が支払金額という紐付けをもって、相手先へ送ることができます。

相手先では、データとして受領認識ができ、仕訳、支払い、支払方法の選定、

会社だけでなく取引部署も含めた意味でとN対Nの相手先の対応も簡単です。

EIPAという団体が推進をしています。

EIPAとはなんですか?

「デジタルインボイス推進協議会」 (英語名称:E-Invoice Promotion Association、以下EIPA)は、日本の公共部門や民間企業の間でデジタルインボイスの普及を促進するために設立された組織です。EIPAは、2020年7月に日本政府のデジタル庁の下部組織として設立されました。EIPAは、デジタルインボイスの標準化、導入に関する情報提供や啓発活動を行っています。

EIPAが推進するデジタルインボイスには、Peppolという欧州の標準規格があります。Peppolは、電子的な調達システムで使用される標準化されたデータ交換フォーマットと通信プロトコルを提供し、異なる国の業者との調達プロセスを効率化することを目的としています。EIPAは、Peppolを日本で導入し、国内の業者と欧州の業者との取引をスムーズにすることを目指しています。

EIPAは、日本におけるデジタルインボイスの導入を推進することで、企業や公共部門の業務プロセスを効率化し、取引のスピードアップやコスト削減などのメリットをもたらすことを目指しています。また、Peppolの導入により、国際的な取引がよりスムーズに行われ、日本企業のグローバル展開を促進することも期待されています。

データ上の利点:OCRの能力限界値を加味しなくていい

紙で受け取るにしても、PDFで受け取るにしても、データを100%読み取るというのは難しいです。

それは、いったん別の形にはきだしているからですね。

これをデータだけでやりとりする状態にできれば、途中での意味情報が途切れることがありません。

また、基本的なことですが数値や文字の読み違えもありません。

Peppolでデータを送る利点はここにあります。

利点の逆も一応紹介すれば、どこまで普及するかや費用がどれくらいかかるかということが簡単に挙げられますので、一応ここに対比しておきます。

EDIとどう違うか?

上記に述べたような利点は、EDI(Electronic Data Interchange)でもできるというツッコミがあるでしょう。

EDIの略を見れば、「電子データを交換すること」となってますし。

でも、EDIの大きな課題は、他のEDIとは互換性がないことです。

それだけで閉じた中にいる状態です。

いうなれば、DOCOMOの電話からDOCOMOへは電話ができても、auへは電話ができない状態です。

そのひとつの枠組みが大きければある程度はこまりませんが、絶対にauに電話しないということもありませんね。

Peppolの利点として、この垣根を超えるための仕組みになるということです。

その結果、どこのシステムを採用しようかで、規格で迷うことがなくなります。

例えば、携帯電話でアンドロイドにするかiOSにするか。

これも規格争いのひとつです。

パソコンディスプレイのHDMIやDisplayPortだった同様に規格争い。

こういった規格の争いが減り、データの流通がしやすくなるというメリットがあります。

ここが大きな違いです。

サービス業者が狙う波及オプションとして

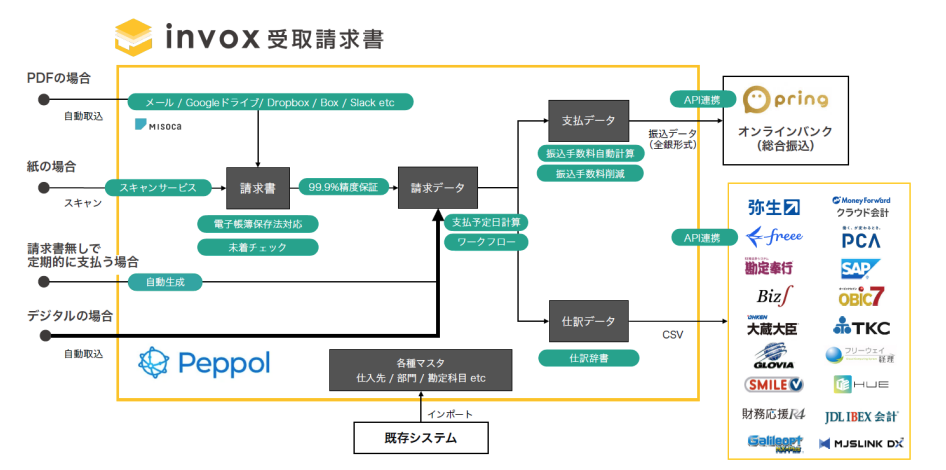

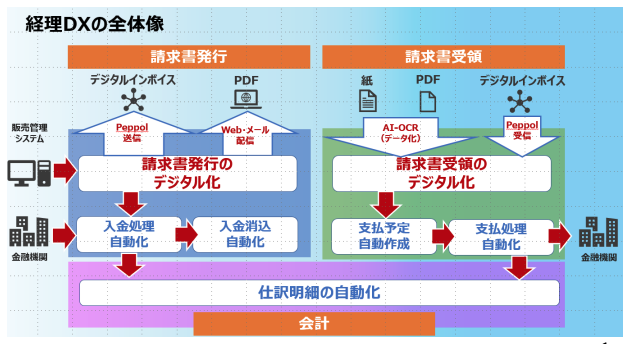

また、データをそのまま受け取ることで、サービス業者は波及的なビジネス展開を望めます。

- 取引データがわかるので、与信を見ることができ貸付につなげられる

- 支払いと預金残高から、必要に応じて貸付を自動で行う

- 支払い方法を支払側が決められる(振込・クレジットなど)

- 社員の立替について、家計簿アプリと連携してデータやり取り処理

お金の動きがわかれば、その周辺についてもサービス展開ができるということです。

データの管理や処理がスムーズになるという点は当たり前なのであまり挙げておりません。

データから仕訳の自動化も可能で、そういったサービスを提供する業者もいらっしゃいます。

Peppol認定アクセスポイント事業者 2022年10月19日現在

Peppolについては、まずアクセスポイントを持つサービスプロバイダーでになるという選択肢があります。

こちらが2022年10月19日現在の一覧です。

- Basware(フィンランド)[OpenPeppol]

- EDICOM CAPITAL S.L.(スペイン)[OpenPeppol]

- ファーストアカウンティング株式会社(日本)[デジタル庁]

- 富士通Japan株式会社(日本)[デジタル庁]

- IBM(米国)[OpenPeppol]

- KMD(NECグループ)(デンマーク)[Danish Business Authority (ERST)]

- 株式会社オージス総研(日本)[デジタル庁]

- OpenText(米国)[OpenPeppol]

- Pagero AB(スウェーデン)[Agency for Digital Government (DIGG)]

- Saphety Level – Trusted Services SA(ポルトガル)[OpenPeppol]

- SEEBURGER AG(ドイツ)[Koordinierungsstelle für IT Standards (KoSIT)]

- Storecove (Datajust B.V.)(オランダ)[Netherlands Peppol Authority (NPA)]

- 株式会社TKC(日本)[デジタル庁]

- 株式会社トラベルデータ(日本)[デジタル庁]

- ウイングアーク1st株式会社(日本)[デジタル庁]

Peppolのサービス業者

早いところは2022年12月からサービス提供開始です。

初期費用と従量課金といったサービス体系になるところが多いという印象です。

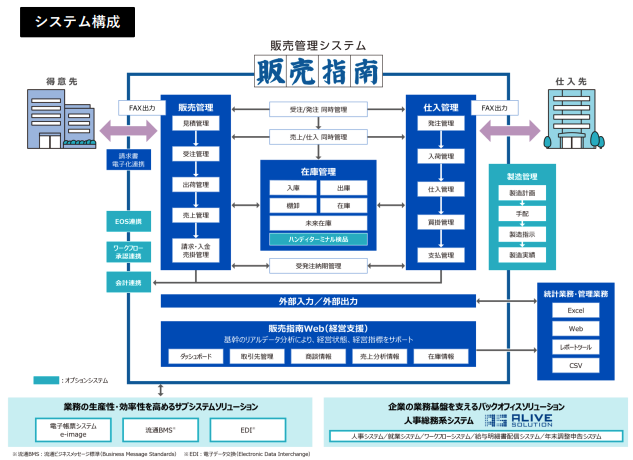

細かなサービスを理解することよりも、どういった業者がどういうイメージで提供をしているか全体をご紹介する方が、デジタルインボイスの理解につながると考えます。

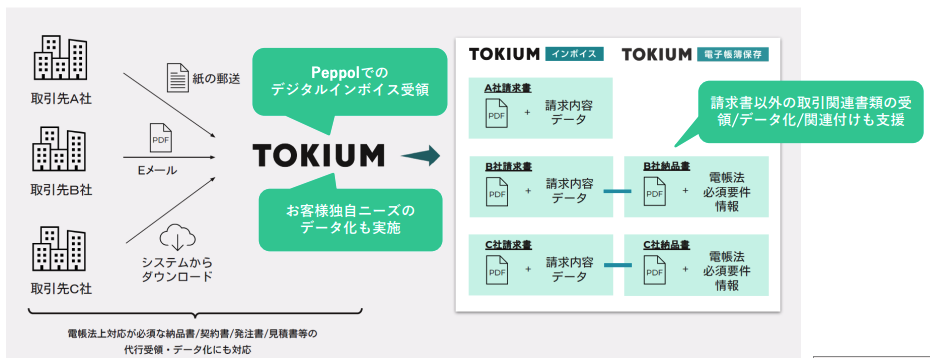

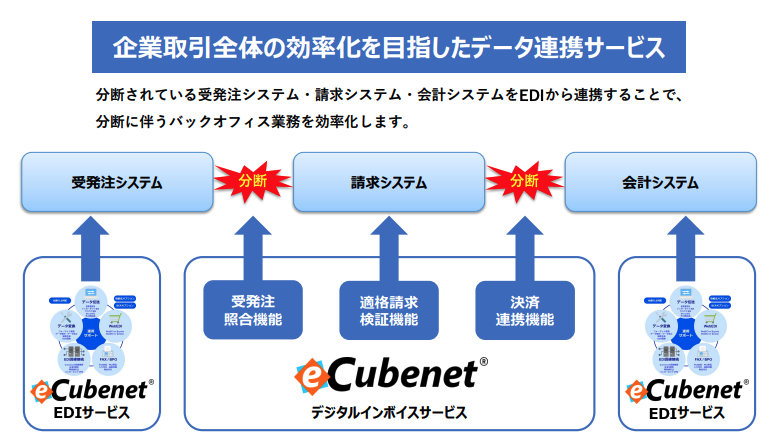

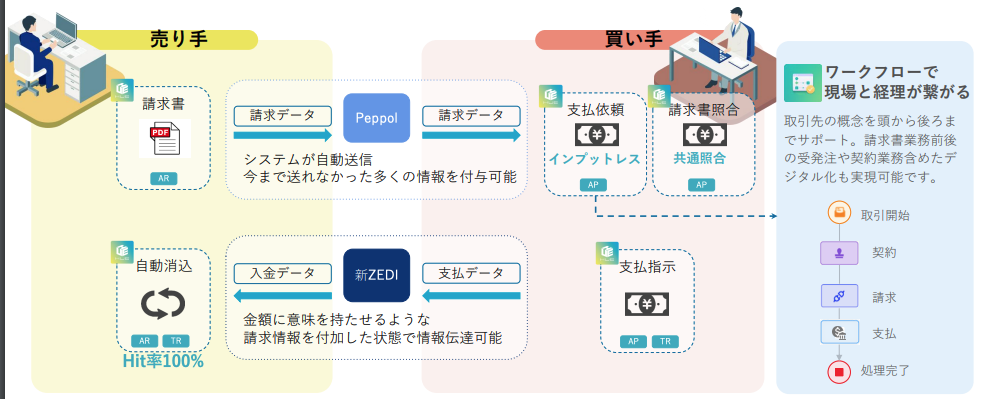

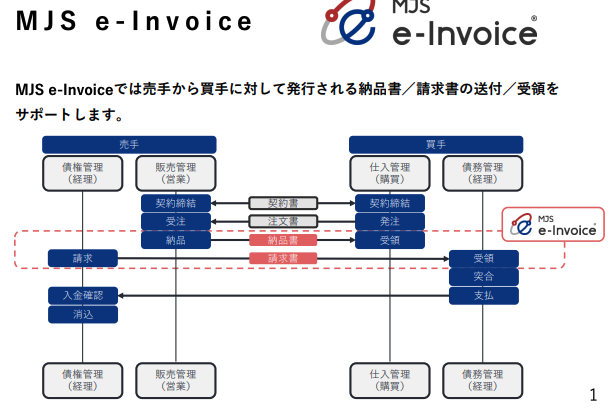

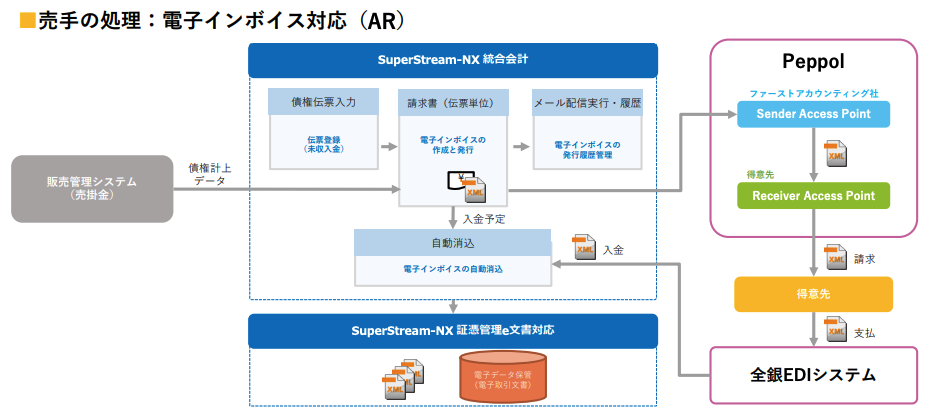

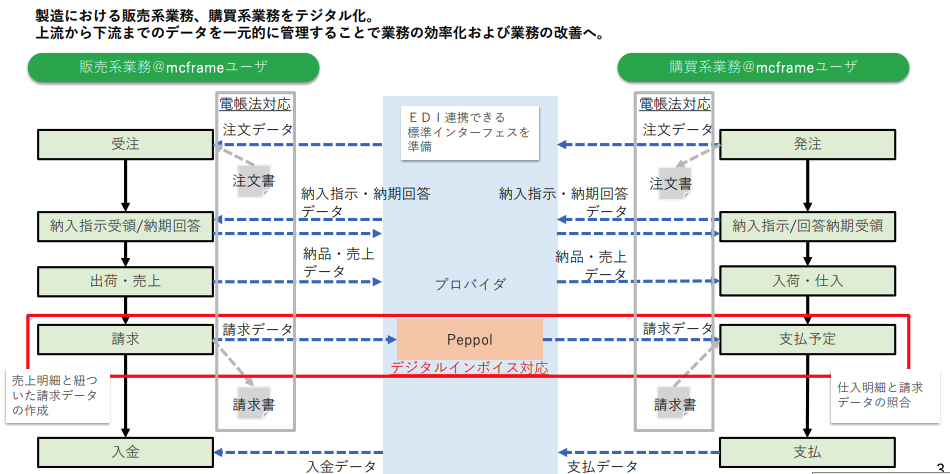

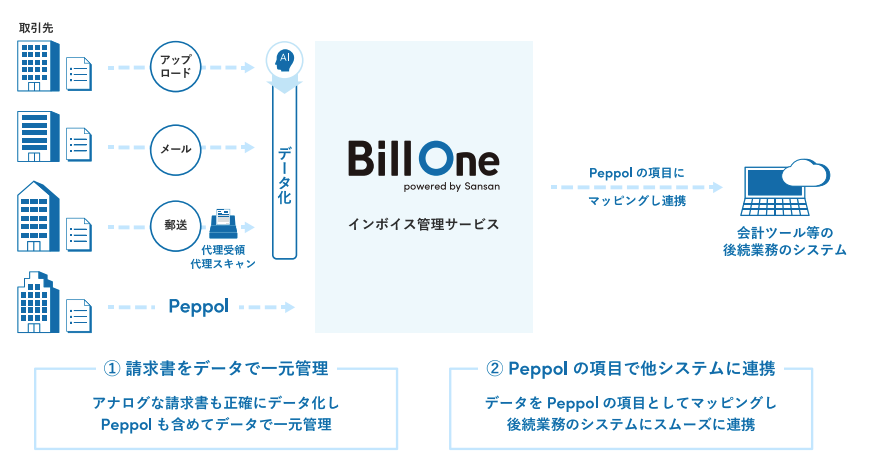

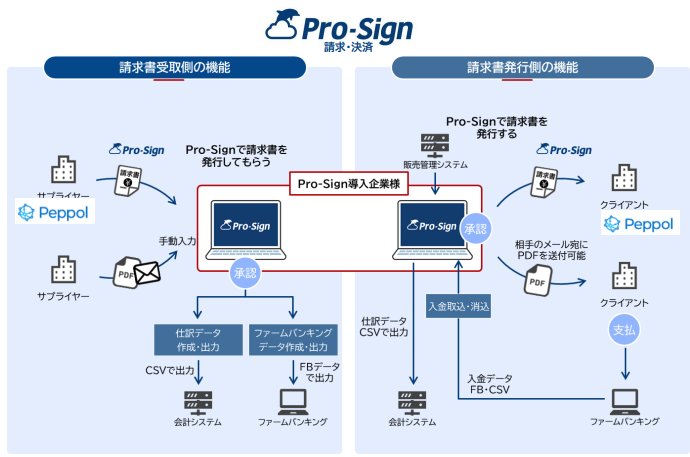

EIPAの説明資料から処理フロー図を引用する形でご紹介をいたします。

TOKIUM

eCubenet

ワークスアプリケーションズ

ミロク情報サービス

SuperStream

Datajust B.V. (Storecove)

ビジネスエンジニアリング株式会社

SAPジャパン

三菱電機ITソリューションズ

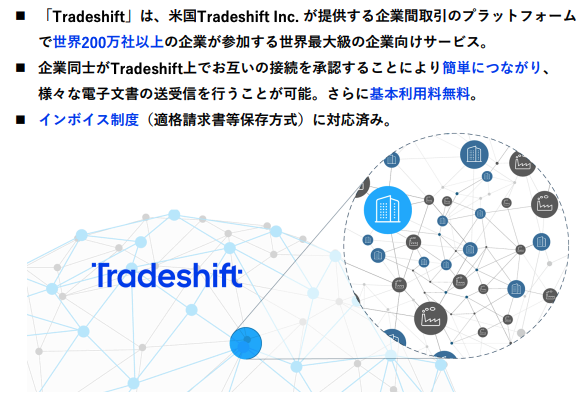

トレードシフトジャパン株式会社

株式会社Deepwork

Sansan株式会社(Bill One)

株式会社オービックビジネスコンサルタント

株式会社プロレド・パートナーズ

過去の例から、本腰入れないと定着が難しい

データのやりとりをしやすくする仕組みとして、でんさいネットのような例もあります。

無料にもかかわらず、普及はそれほどです。

2021年11月のでんさいネット統計資料から、電子記録債権は大企業で13.7%、中小企業8.5%で、小企業で6.8%です。

便利ですし手数料もかからないのにあまり普及していません。

慣習を変えることがうまくいかなかったり、変わると収益が減る関係者の方もいるため、うまく定着していません。

デジタルインボイスも同様の壁に当たると考えられます。

調整に時間がかかったからでしょうが、2020年、電子帳簿保存法やインボイス制度が話題にのぼった辺りから選択肢としてサービス提供があるとうれしかったです。

いずれにせよ、経営者の方は、今後デジタルインボイスを選択するかの場面が出てくるでしょう。

情報収集をして、効率的な会社運営につなげたいですね。